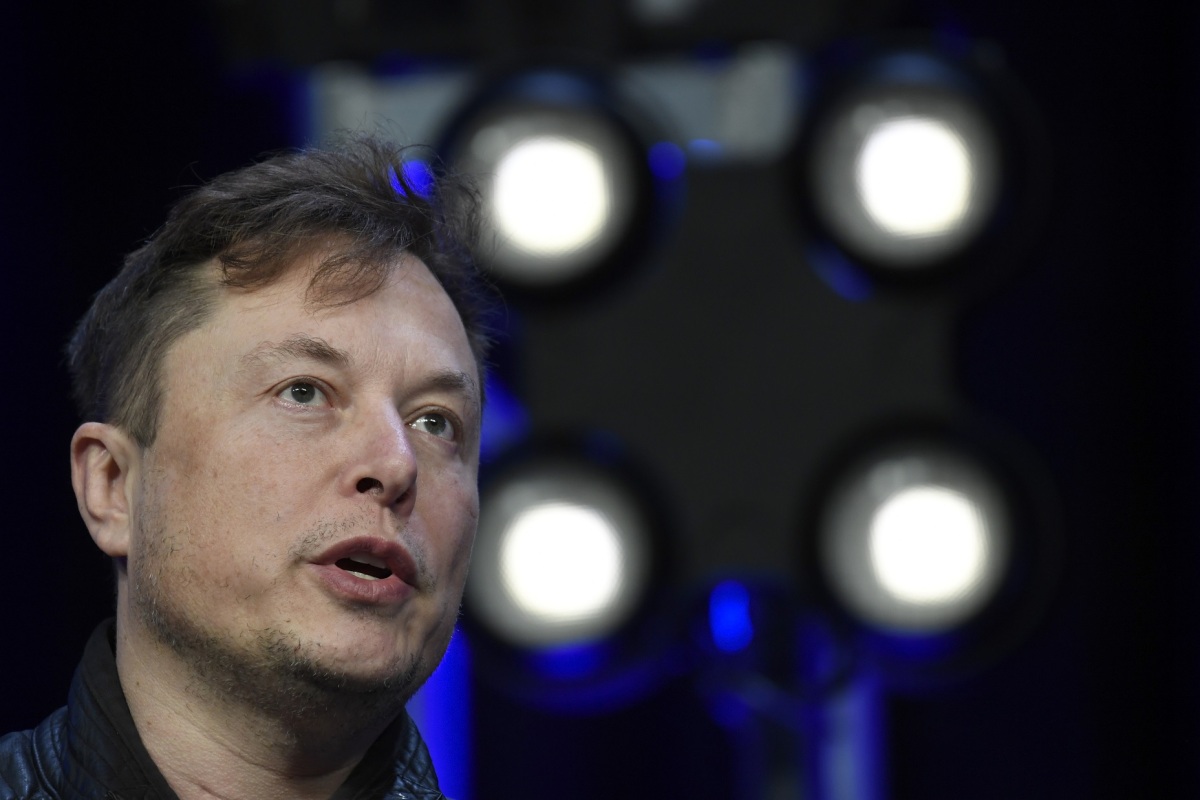

According to Reuters, Tesla CEO Elon Musk stated on July 23 that the repeal of the electric vehicle tax credit under US President Donald Trump's "One Big Beautiful Bill Act" could lead to "several tough quarters" for the company.

Addressing questions about the act, Musk said that the company may face "a few rough quarters." According to Musk, this could affect Q4, Q1, and even Q2. Following his comments, Tesla's stock dropped nearly 5%.

Tesla disclosed its most significant quarterly sales decline in over a decade and earnings below Wall Street expectations. Despite launching a revamped version of its best-selling Model Y, the company posted its second consecutive quarterly revenue decline, down 12% year-over-year. Regulatory credit sales plunged 51%, further impacting revenue and profitability.

Global deliveries fell 13.5% in Q2, with revenue for the April-June quarter at US$22.5 billion, down from US$25.5 billion in the same period last year. Adjusted earnings per share came in at US$0.40, missing Wall Street consensus. However, Tesla's automotive gross margin (excluding regulatory credits) reached 14.96%, exceeding analyst forecasts, thanks to lower per-vehicle costs.

Price and profit margins remain critical for Tesla as it faces a dual challenge of declining demand and reduced government support.

In response to demand concerns, Tesla is developing a more affordable vehicle. However, CFO Vaibhav Taneja noted that production of the new model is progressing slower than anticipated and will ramp up gradually next quarter.

Jacob Byrne, an eMarketer analyst, pointed out that given Tesla's recent struggles, its disappointing performance is not surprising. If Tesla can successfully position an affordable model while maintaining the appeal of its premium offerings, it could significantly boost sales.

Related News:

'One Big Beautiful Bill Act' could push US deficit to US$3.4 tn, leave 10 mn uninsured

Comment