The Inland Revenue Department (IRD) reminds the public that Tax Returns for Individuals for the 2024/25 Assessment Year have been issued. Taxpayers are generally required to submit their returns by June 2, 2025.

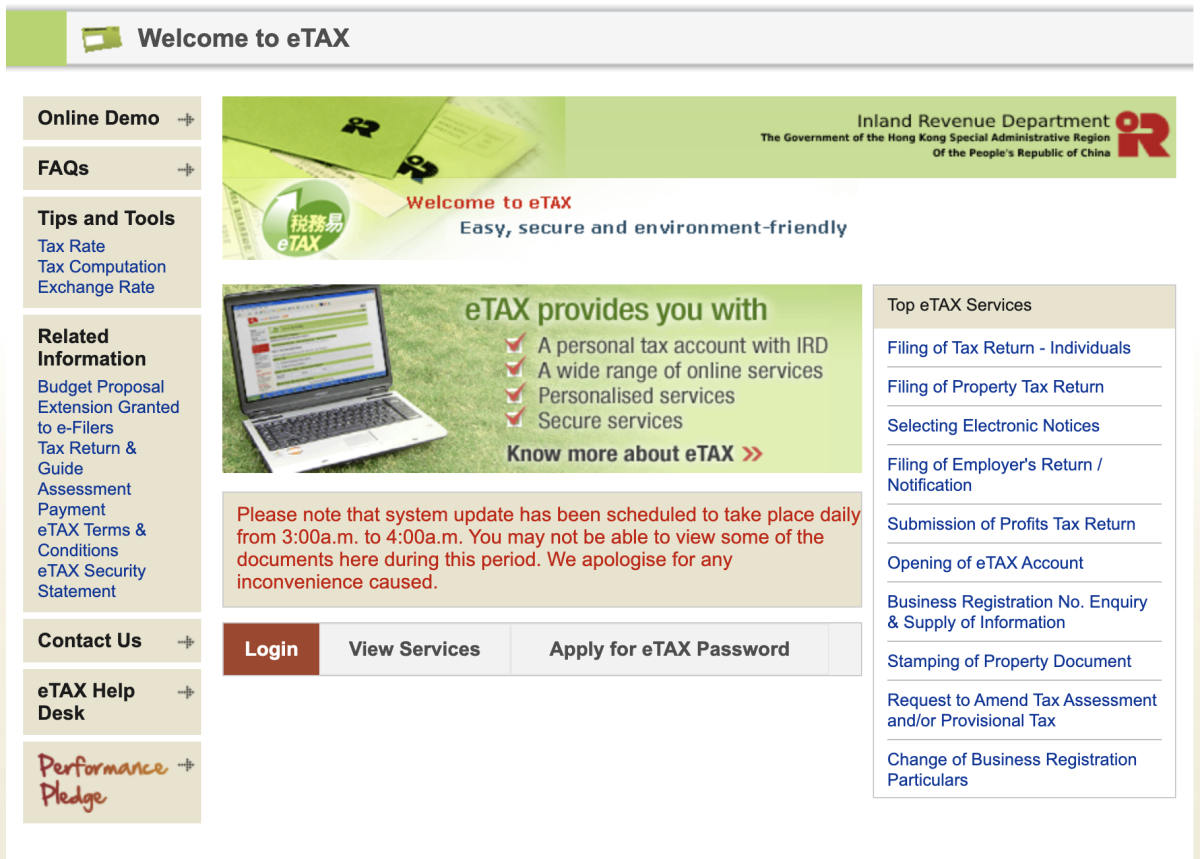

An automatic one-month extension until July 2, 2025, applies to returns filed electronically via the "eTAX" (Electronic Tax Services Platform).

The IRD encourages taxpayers to use the convenient, secure, and environmentally friendly eTAX service, which also guarantees timely submission. Taxpayers opting to file paper returns must affix sufficient postage to their mail to ensure accurate and punctual delivery to the Department.

Key Deadlines for 2024/25 Assessment Year:

General Individuals:

Paper Filing Deadline: By June 2, 2025

e-Filing Deadline: By July 2, 2025

Individuals Carrying on a Sole Proprietorship Business:

Paper Filing Deadline: By August 2, 2025

e-Filing Deadline: By September 2, 2025

Related News:

Watch This | China's optimized tax refund policies boost inbound consumption

1-minute News | New tax refund initiatives for tourists in China: What you need to know!

Comment