A Brief Analysis on the Increment in Trading Stamp Duty

By Levin Wang, CEO of Huatai Financial Holding

On February 24, the Hong Kong government announced the 2020-21 Budget, which mentioned an increase of stock trading stamp duty rate for the first time in 28 years. According to the new proposal, the stock stamp duty rate will be increased to 0.13% from the current buyer and seller each paying 0.1% of the transaction amount. The market reacted quickly to the news. The southbound net inflows immediately turned negative, and the Hang Seng Index fluctuated dramatically. At the close, it was down more than 1,000 points, or 2.99%, from its intraday high.

Around the world, each increase/decrease of stock stamp duty in history will be accompanied by a fall/rise in the stock market. In 2008, when the trading stamp duty on A-shares was reduced, it also jumped by 9.45%. Under normal circumstances, the adjustment of trading stamp duty has a one-time impact on the stock market. As the market gradually digests this news, stock prices will also tend to recover.

The Hong Kong stock market has experienced the biggest one-day decline YTD. Apart from the adjustment of trading stamp duty, it seems that Hong Kong stock markets have indeed been in an over-trading state since the New Year. As of the end of February 23, the average daily turnover of HKEX rose to approximately US$28 billion, compared with only US$10 billion in the same period last year. The average daily turnover of HKEX is nearly five times that of the London Stock Exchange in the same period and 67% of the New York Stock Exchange. The market showed an overbought situation, and the news of tax hikes triggered investors' anxiety. On February 25, the Hang Seng Index has quickly stabilized and recovered to 30,000 points, indicating that the market is already digesting the information and recovering from extreme emotions.

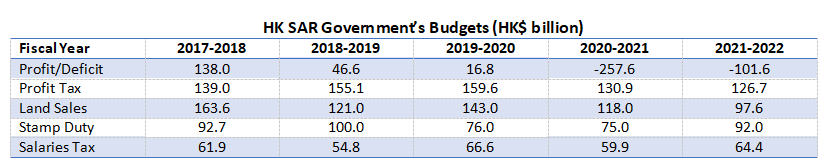

The government should be aware of the possible decline caused by tax hike, but they still proposed it after careful consideration. The reason is Hong Kong government has an urgent need to alleviate its fiscal deficit. According to the latest budget, the Hong Kong government's budget deficit for 2020-21 is HKD 257.6 billion, which will reduce Hong Kong's government fiscal reserves to HKD 902.7 billion at the end of March 2021. And the projected deficit for 2021-22 is HKD 101.6 billion. As mentioned before, the current trading volume in HKEX is at a relatively high level, which means now the market has a strong ability to undertake the effect of tax hike. Assuming that next year's stamp duty revenue is 90 billion (average value of 87.1 billion in the past 5 years) and stock stamp duty accounts for 50% of all stamp duties, this 30 percent tax increase will bring in additional income of HKD 13.5 billion, which is about 0.5% of Hong Kong's GDP. The additional income can relieve deficit pressure to a certain extent.

In addition to alleviating the pressure on the current deficit, the increase in the stock stamp duty rate can also bring an important by-product. Participants in the capital market are usually middle and high-income groups, which means that the levy of stock stamp duty will mainly affect them. The Hong Kong economy has been severely affected by Covid-19. Meanwhile, ordinary income groups may experience income instability. Considering this situation, the Hong Kong government can only start from the middle and high income groups if they want to increase taxes, while minimizing the additional burden on low income groups. Using stock stamp duty as a vehicle for policy adjustments can effectively achieve above effects. To a certain extent, this is also a secondary distribution of social wealth and can play a role in reducing the gap between the rich and the poor.

Going further, we can ask ourselves, are there any other handy measures can be adopted to increase the government revenue amid the outbreak of COVID-19? I am afraid not. Whether it is the increment in the trading stamp duty we have seen recently, or the attributes of "low tax rates, high house prices, high land sales income, and weak government intervention" embedded in the Hong Kong economy, they are both endogenous results of some pre-determined factors.

The four major sources of government revenue in Hong Kong have traditionally been the following order: profit tax, land sales income, stamp duty, and salaries tax. These sources together account for 70% of total government revenue. In the continuing situation of the epidemic, a large number of small and medium-sized enterprises are still struggling to survive, and thus an increment in the profit tax is not favorable; In the real estate market, the absence of 10% of south bound buyers in the previous years and the volatility of the housing price index suggest that the SAR government will not make cliff-edge policy changes on the land supply side; As for salaries tax, not only does it contribute less to fiscal revenue, but its adjustment generally involves multiple interests and requires comprehensive social consultation, which is not suitable for use as a flexible policy tool. What's more, in the current situation of high unemployment, the tax burden of enterprises after the increment in salaries tax may make the citizens' lives more difficult.

Therefore, the increment in trading stamp duty finally became the only solution: high policy flexibility (easy to increase or decrease), target groups in line with the main purpose of secondary distribution of wealth (high-frequency trading groups in the stock market or new foreign investors), and a considerable amount of levy. Although it is the first trading stamp duty hike in 28 years, in light of the current background, the Hong Kong SAR Government's approach has been regarded as "mission impossible".

Finally, I have also seen some media using Singapore as a comparison. After all, the relationship between the two cities has always been regarded as the York and Lancaster in the War of Roses. It just happens that Singapore also released its 2021-22 budget recently. As everyone knows, Singapore has consumption tax, which is currently 7% and plans to increase it to 9%. Although the increase was postponed due to the epidemic, the postponement will not be too long. It will definitely be implemented during 2022-2025, and there will be basically no callback after implementation. The increase in fiscal revenue from the consumption tax hike is equivalent to about 0.7% of GDP, which is exactly the same level as my previous estimate of contribution of Hong Kong's stamp duty hike of about 0.5% of GDP. Furthermore, for similar reasons, Singapore cannot raise the profits tax and salaries tax; in addition, Singapore's HUDC/HDB program also prevents its fiscal revenue from relying on land sales. But what is interesting is that, as symbolic institutions of national capitalism, Temasek and GIC use their geographical endowments and rich experience in international investment to steadily contribute about 20%~25% of non-tax revenue each year. This proportion happens to be the proportion of land sales in Hong Kong's fiscal revenue. As the so-called "One man's meat is another man's poison".

"Why Nations Fail?", a book written by MIT economics professor Acemoglu, explains the proposition that "An inclusive democratic system is the only way out for economic prosperous". It has been highly endorsed by the European and American politicians as soon as it was published. But in fact, if you look deeper, you will find that Acemoglu's book has been strongly criticized by other economists as two main deficiencies. First, the causal relationship that "Some certain political institutions are the prerequisite for economic prosperous" does not hold; second, it ignores the impact of resource endowments on the economic development.

Pulling back, whether it is stamp duty or consumption tax, high housing prices or Temasek, what these facts reflect are two different political and economic natures: Hong Kong's governing ideology combination of "low tax rate + high land sales income + weak government intervention", and Singapore's "low house prices + authoritarian political system + national capitalism". These phenomena or results have their endogenous logic. Fundamentally speaking, the two cities are two different political and economic models spawned under specific resource endowments, historical background, and institutional arrangements.

There is no specific political system can derive the economic prosperous. Only by clarifying these questions will we be able to see through the relationship between short-term changes and long-term trends, and have a deeper understanding of different capital markets, different political systems, and different economic forms.

The views do not necessarily reflect those of DotDotNews.

Comment