by Angelo Giuliano, Political and financial analyst

It always comes down to the wallet, nothing else. Here it is all about China challenging the dollar hegemony and a possible reset of the world monetary order.

In order to better understand the present situation, it is important to go back to history, to the origin of the dollar supremacy as the main global currency.

The USA played a subtle role before and during World War II, a "divide and conquer" strategy by first supporting Hitler as he was a contender against the rise of communism in Germany and later by financing the Union of Soviet Socialist Republics (USSR) against Germany.

Once the war was over, continental Europe and Russia were completely destroyed. Hollywood did work well to rewrite history and to sell and indoctrinate the world about the US savior and the good wining against the evil while in my humble opinion, they were all butchers with the difference that the best butcher won, ultimately humanity lost.

In February 1945, there was the Yalta conference where the two remaining superpowers agreed on sharing two new blocs, later called NATO and Warsaw Pact.

Previously in July 1944, most countries met to establish a new monetary world order where the dollar would become the reference currency, which was pegged to gold, meaning that any country national bank could go to the Federal bank and exchange their dollar excess against a defined quantity of gold.

The USA had a mastermind plan, it had already been the largest economy in the world as it was never disrupted during WWII, on the contrary, it was producing military equipment for most of the countries in the conflict. Right after the war, they decided to do the Marshall Plan, the USA was providing loans mainly to Europe for reconstruction.

It was a good way for the USA to recycle its trade surplus into Europe which in return would keep on buying American goods.

The dollar back then had value since it was backed by gold, a tangible asset.

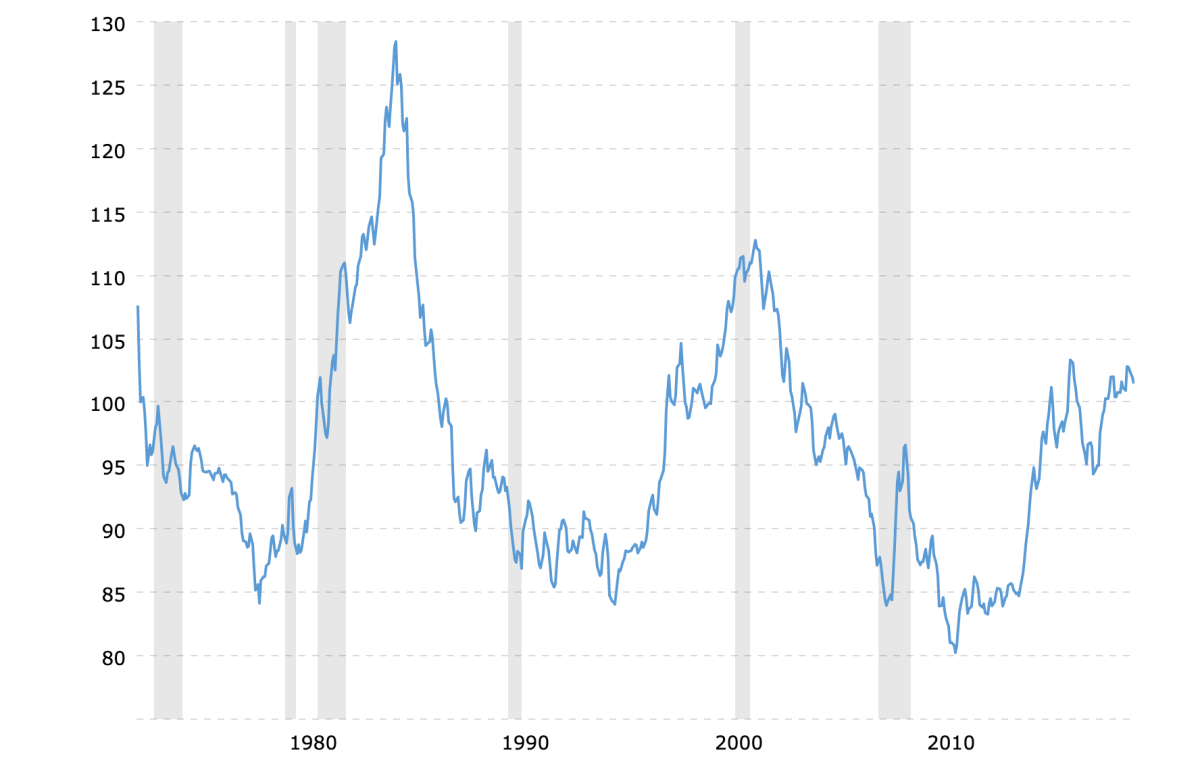

All of a sudden in 1976 the USA unilaterally decided to put an end to the convertibility of dollars into gold, meaning that the value of the dollar became intangible and went into a Ponzi scheme of endless printing.

The model could be sustainable as long as the USA had a trade surplus and could keep on recycling the dollar excess in its customer markets.

Then with time and globalization, other sourcing/production options came with countries starting to have a trade surplus with the USA, mainly Germany, Japan and then later China.

They were recycling their excess dollars into US bonds, meaning financing US debt and American high standard of living.

In a normal world where the US dollar was not a global currency, the oversupply of the US dollar would create hyperinflation while having the US dollar being the world currency, the printing currency quantities became just endless.

The difference is that in the last decade the trend of recycling US dollars from the major trade surplus economies (Germany, Japan, China) has changed. They used to buy bonds, now the increase of dollar supply comes mainly from pure printing.

China has made a risky move, from the US perspective it is a "de facto" war declaration: recycle its dollar trade surplus into the BRI, trillions of dollars not going back to the USA but used to build infrastructure killing many birds with one stone:

- Recycle US dollars into tangible assets

- Shift the trade-business gravity towards Eurasia

- With the BRI, expand China's market reach

- Create a new front of allies, the Greater South or the non-NATO, nonaligned World (mainly Central Asia and Africa)

In addition that China has started to trade with non-dollar denominated currencies (rubble, renminbi) with large partners such as Iran, Russia, Venezuela. Remembering here that the real value of the dollar is in its wide adoption, the trust of a large number of market participants in a paper which otherwise would be just worthless, a paper-toilet currency.

Iraq and Libya had tried to do that, Khadhafi had even tried to create a currency (dinar) for Africa that would have been backed by gold. Both Saddam Hussein and Khadhafi paid with their life the challenge of the dollar supremacy.

Back during the Opium War, it was not much different, China had a huge trade surplus with England which was purchasing huge amounts of tea against silver, a China trade surplus that ultimately dried-up England of silver until it came up with a strategy to impose China the purchase of its evil opium in order to re-balance trade and enslave Chinese into opium.

The Ponzi scheme is coming to an end with the depolarization trend, the outcome would be a hot war against Russia and China at worst or at best a reset of a new world order with new monetary rules, a new Bretton Woods. China might need to rescue/bailout again the USA, because the arrogant bastard is hurt where it hurts the most: its wallet and its exuberant living standards built on the control of the Greater South, oil-rich countries, Africa and South America.

The 800-military basis in the world is the stick that the US is using to tell the world that a country with 4% of the world population won't give up on its neo-colonialist aspiration, it is racist and supremacist with a culture of exceptionalism and assumption of being the chosen by God to impose its rule and values to the world.

I don't want my son to live in a world like this, the future should be about a multipolar world and end of the oppression of the Greater South, give back dignity and sovereignty to oppressed people, ultimately put an end to neo-colonialism.

The views do not necessarily reflect those of DotDotNews.

Comment