The homecoming of China concept stocks

By Levin Wang, Doctorate of Economics from Renmin University of China

Chinese stock listed overseas is no longer a new subject to the market. As of June 2020, there are 248 Chinese companies listed in the US with a total market cap of USD 1.6 trillion, which represents 35% of the H-share. However, with the US government's recent new regulatory changes on overseas companies listed in the US, the homecoming of China ADRs has again been brought to the spotlight.

It is obvious that the return of China ADRs will not only benefit the regional investors with Chinese new economic growth dividend, but also help the Chinese issuers for a better valuation and local recognition.

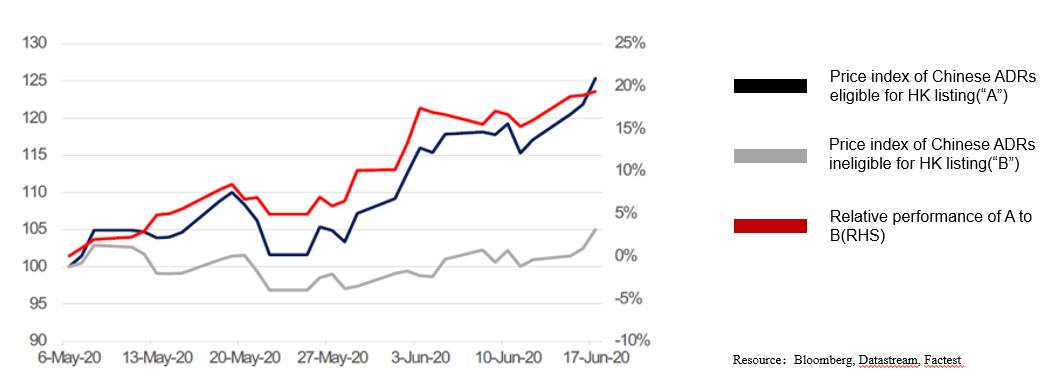

The share prices show that China ADRs eligible for HK secondary listing delivered a substantially better performance than those that will, in the short term, remain listed in the US.

Figure 1. Comparison of eligible and ineligible China ADRs for HK secondary listing

More importantly, we believe the challenging regulatory and political environment in the US will create a new growth engine for Hong Kong to become an even stronger financial center in the world. The forced return of China ADRs will likely lead to a bullish trend in the technology, biological medicine, and high-end manufacturing sectors -or the so-called "new economy" sectors.

We have three pillars to back up our story.

First of all, Hong Kong is best positioned to benefit from the return of China ADRs. Hong Kong stock exchange has ranked no.1 IPO venue in the world for 7 years out of 11.

Over the past year, Hong Kong has experienced a wide-spread social unrest along with effects of the COVID-19 pandemic. However, Hong Kong's financial market, especially the Hong Kong stock exchange, has demonstrated a strong and robust performance over this time.

As of July 2020, total capital raised via IPO reached over USD 17bn and daily average trading turnover has increased over 40% year on year. As a result, Hong Kong Stock Exchange has seen its historical high on July 20.

Figure 2. Hong Kong Stock Exchange has reached historical high in July

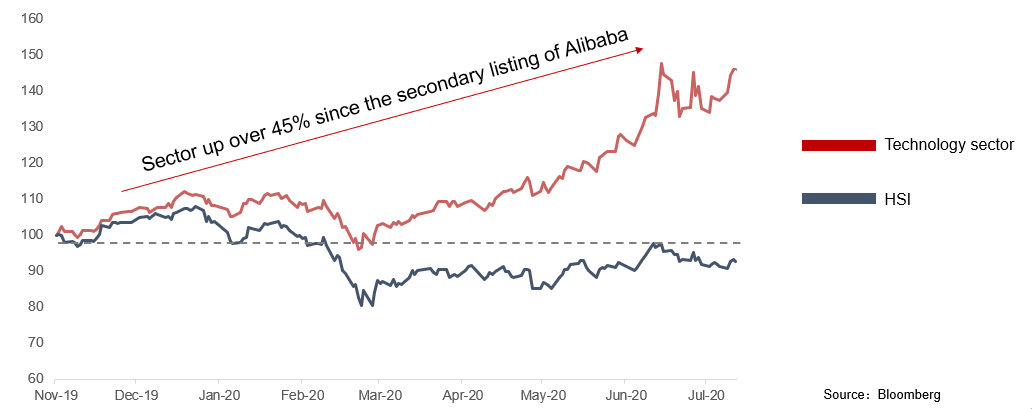

Particularly, we have seen new economic stocks taking an increasingly important representation in the H-share market, and significantly outperform the overall Hang Seng Index. This provides strong fundamentals for China ADRs to come back home.

Figure 3. Technology stocks significantly outperform Hang Seng Index

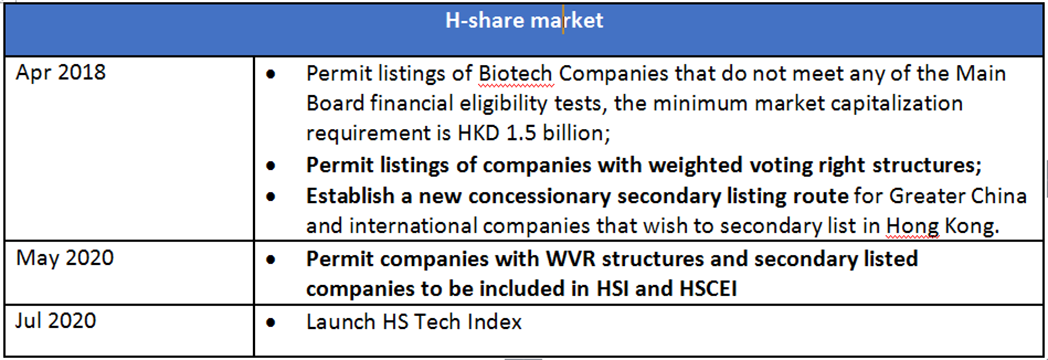

Secondly, favorable policies are already in place for return of China ADRs including new economy companies.

To welcome China ADRs, regulators in Hong Kong have implemented a series of effective and supportive policies. In April 2018, Hong Kong lifted the requirement for financial eligibility test on Biotech companies and accepted the listing of companies with a weighted voting rights (WVR) structure.

In addition, Hong Kong has established a new concessionary secondary listing route which provides an ideal option for large China ADRs to come back and get listed in Hong Kong.

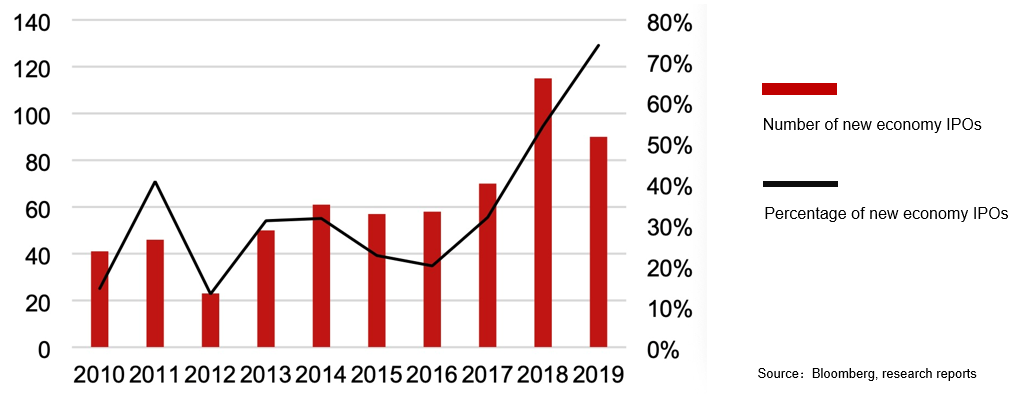

These supportive policies led to a surge in IPOs of new economy companies, which accounted for 74% of Hong Kong's 2019 IPO.

Figure 4. Structural change of Hong Kong IPO with new economy companies taking 74% in 2019

As a result, Hong Kong has been able to successfully accommodate the secondary listing of China ADRs including Alibaba, JD.com and Netease over the past 9 months. In addition, the inclusion of WVR companies in HSI and launch of Hang Seng technology index are expected to make Hong Kong stock exchange more attractive to new economic companies and the homecoming China ADRs.

Last but not least, we have a fast-developing stock connection mechanism, which will attract all types of investors.

The Hong Kong-Mainland Stock Connect has experienced significant growth over the past few years with total trading turnover reaching RMB36trillion as of May 2020. The well-established connection makes Hong Kong Stock Exchange a perfect listing venue for China ADRs, as Hong Kong will be able to gather investors from both international and home markets.

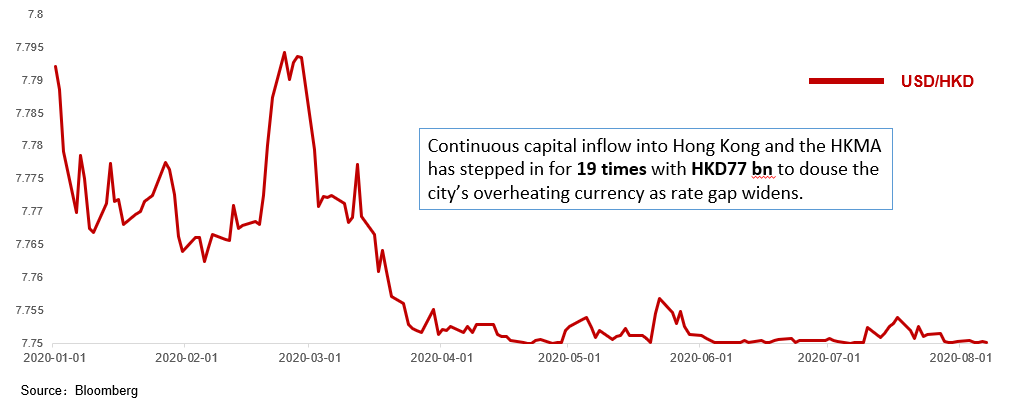

After the quantitative easing approach adopted by the US and other major economies, international investors are keen on looking for assets with a Chinese element. Hong Kong is the key window for entering into China and we see continuous capital inflow into Hong Kong. Recently, the HKMA has stepped in 19 times and injected HKD77.2bn to douse the city's overheating currency as rate gap widens.

Figure 5. Strong currency demand for Hong Kong dollars reflects confidence

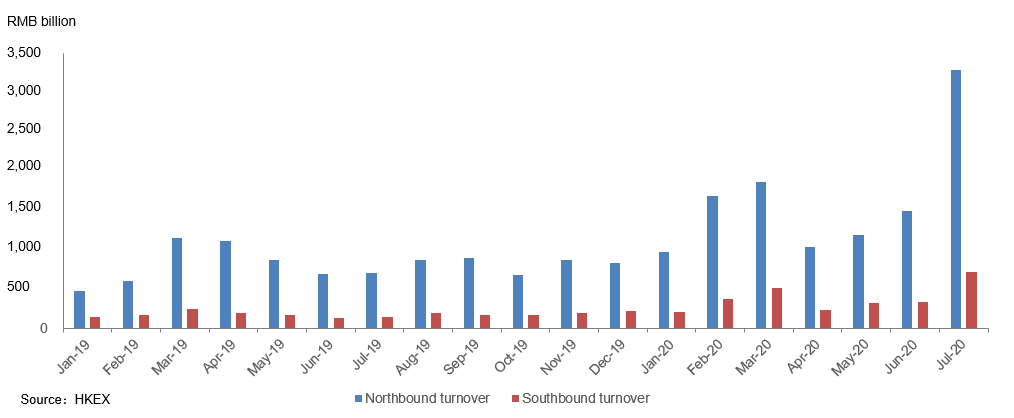

On the other hand, we have also seen fast growing cross-board trading activities conducted via the HK-mainland connect.

Figure 6. Growth of capital flow via Hong Kong – Mainland China connect

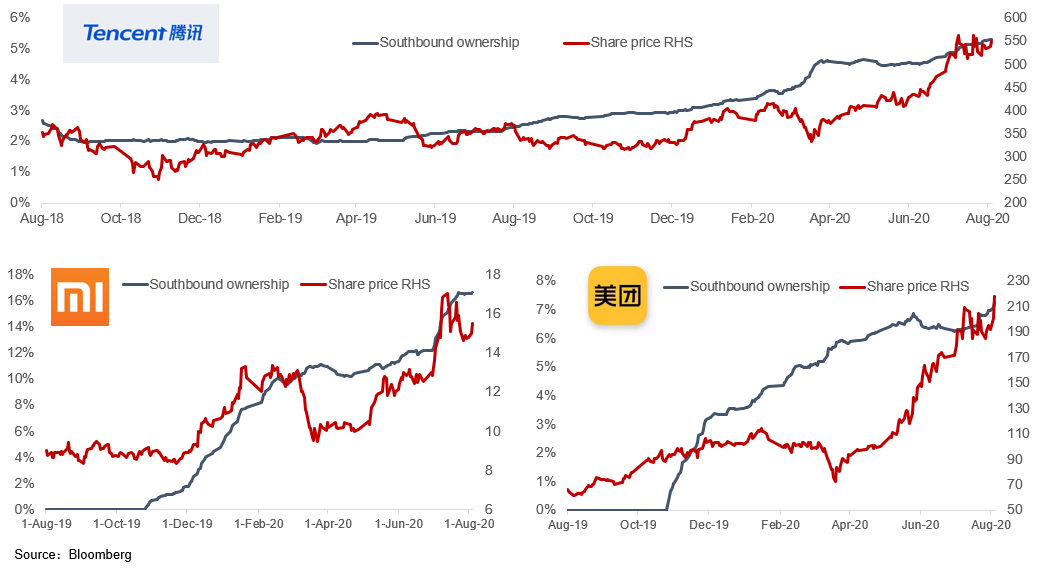

And it was obvious that the southbound investment has supported the share price of those new economy companies.

Figure 7. Southbound ownership support strongly the share price performance of new economy stocks

Therefore, for the homecoming ADRs, significant demand from home market is expected, considering China's high deposit rate as well as the enthusiasm to the new economy concept among the Chinese population. Similarly, given the profit-driven nature of capital, investment from international investors is also expected to remain.

We believe, with its financial center position and mainland China connection, this trend of China ADR return may make Hong Kong the emerging Nasdaq in the east, to attract investors from all over the world for those new economy companies.

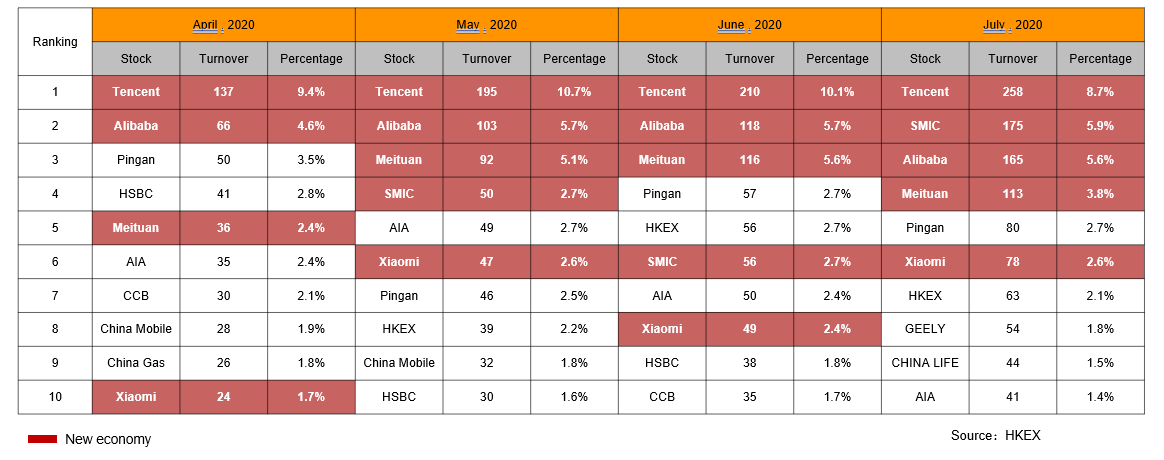

As you can see, among the top 10 traded stocks in Hong Kong, new economy companies account for half of them and we expect this trend to continue as more new economy China ADRs return.

Figure 8. New economy companies attract significant liquidity into the Hong Kong market

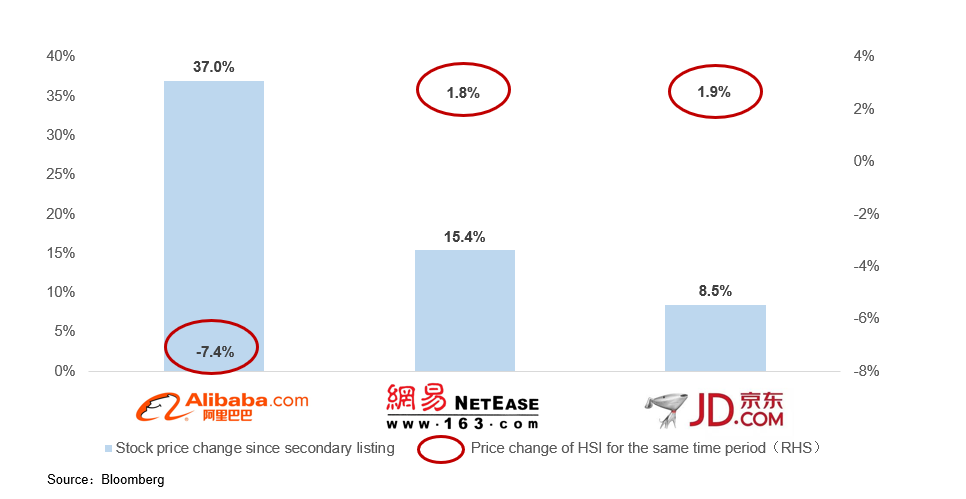

Particularly, the three internet leaders that recently return to Hong Kong have all seen strong share price enhancement. Further price improvement should be expected once they are included in the Hong Kong-Mainland Connect when they can tap into the Chinese retail investor base.

Figure 9. Share price performance of recently returned China ADRs

It is worth mentioning, the increasingly harsh environment in the US financial market, has given Hong Kong the opportunity to attract more investors and quality companies to its financial market. We believe the homecoming of those Chinese ADRs will also gradually improve the pricing power of Hong Kong, especially for the new economy-related companies.

In summary, by leveraging its favorable policies and international financial center position, Hong Kong may be best positioned in the trend of China ADRs coming home. In other words, the headwinds and uncertainties faced by Hong Kong may, on the opposite, make Hong Kong an even stronger financial center in the world. At the same time, we are expecting to see a bullish trend in new economy concept stocks, lit up by the return of China ADRs.

Comment